Share

The fast food industry in France has experienced significant growth throughout 2023, driven by increasing consumer demand, market expansion, and a rising number of outlets. This article provides a detailed analysis of the essential statistics and trends that are shaping the industry, incorporating data from both international and French sources to give a comprehensive overview.

Market Expansion and Revenue Growth

France’s fast food sector has seen a substantial increase in both market size and revenue, reflecting its resilience and the continued popularity of quick-service meals.

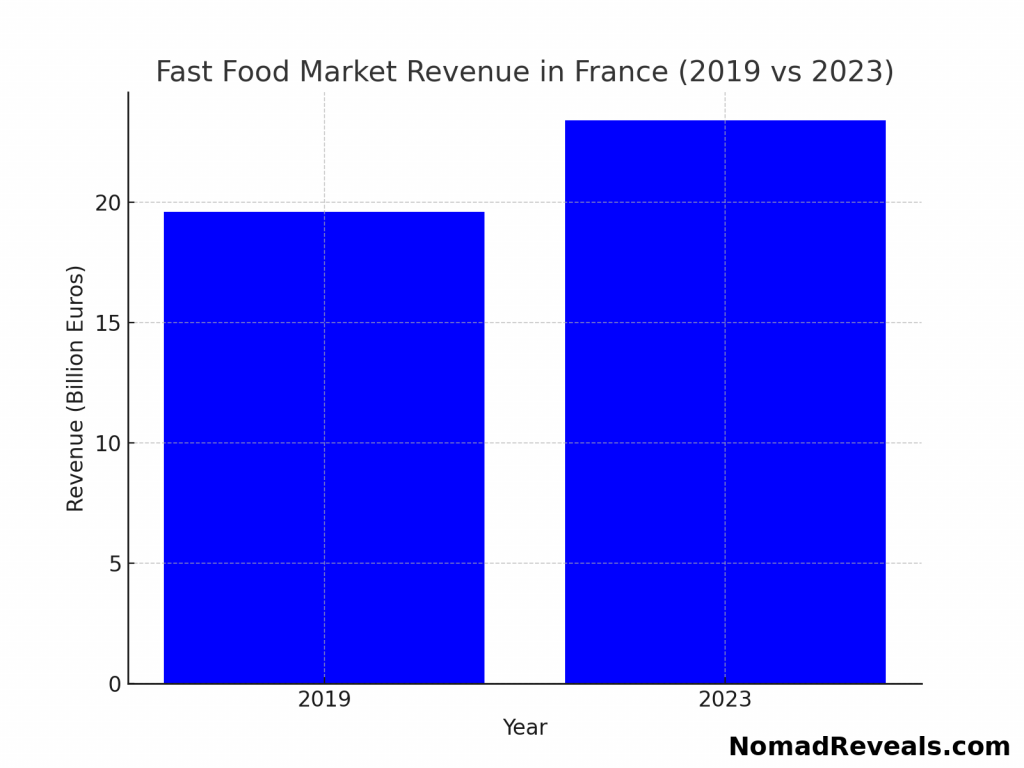

- Revenue Growth: The industry generated approximately €23.4 billion in revenue during 2023, representing a significant 19% increase from 2019. This growth underscores the sector’s ability to recover and expand beyond pre-pandemic levels. According to INSEE (Institut National de la Statistique et des Études Économiques), the broader foodservice sector, which includes fast food, contributed significantly to the overall economic activity in 2023.

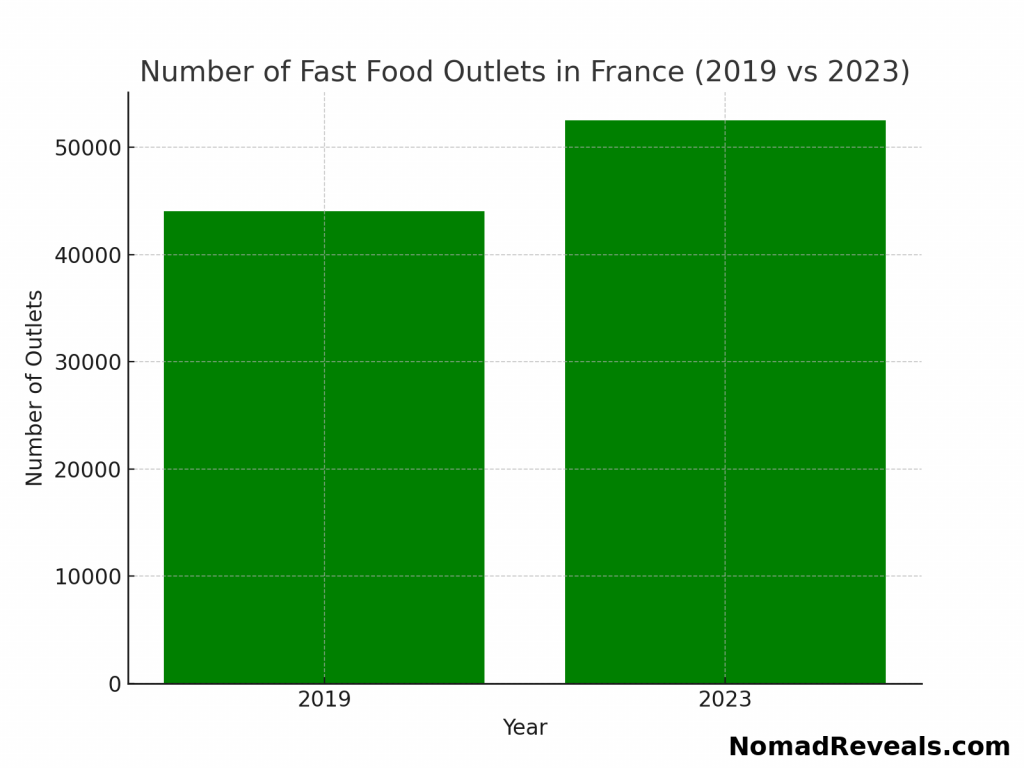

- Outlet Proliferation: By the end of 2023, France had over 52,500 fast food establishments, a notable rise from the 44,000 recorded in 2019. This increase reflects the growing consumer appetite for quick-service meals, as well as the expansion of both domestic and international chains.

Sources: INSEE, The Connexion

Dominant Fast Food Chains and Consumer Preferences

Several well-known chains continue to dominate the French fast food market, with newer entrants also making a significant impact. Consumer preferences are increasingly diverse, driven by both brand loyalty and the introduction of new options.

- McDonald’s Presence: McDonald’s remains a leading player with over 1,515 outlets across the country, maintaining its popularity among French consumers. The brand has successfully adapted to local tastes while leveraging its global brand recognition. According to Gira Conseil, McDonald’s holds the largest market share among fast food chains in France, thanks to its strategic focus on localization and innovation.

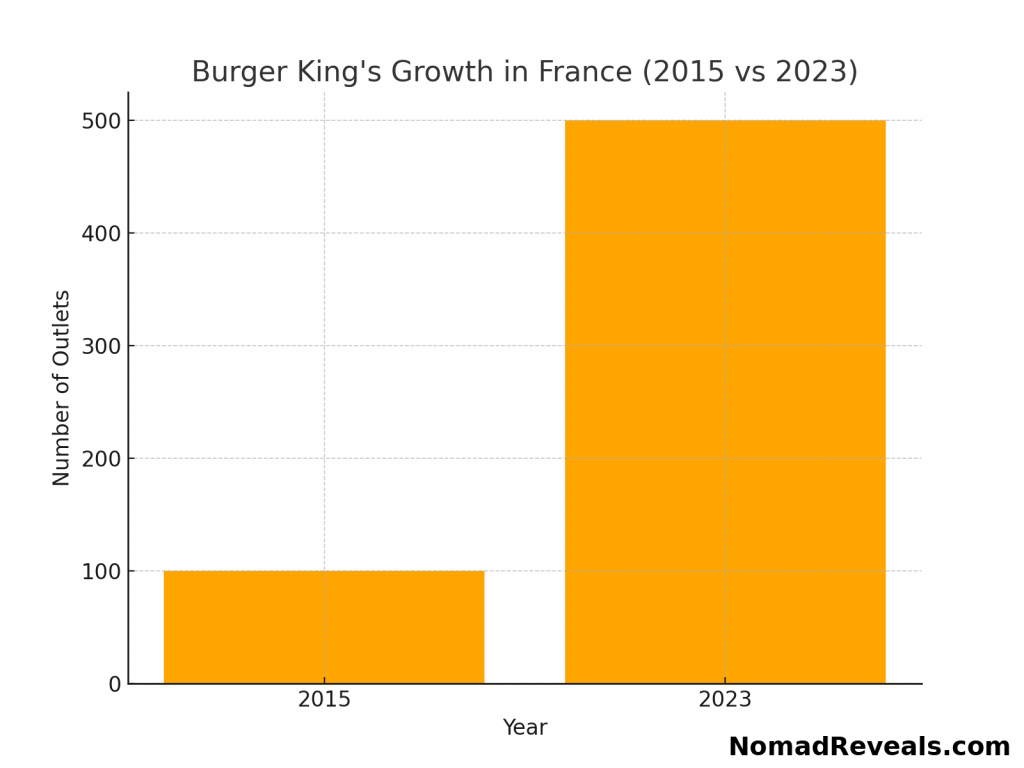

- Burger King and Popeyes: Burger King has been rapidly expanding since its re-entry into the French market, increasing its footprint significantly. Meanwhile, Popeyes, an American chain, launched its first French outlet in Paris in early 2023, signaling the ongoing diversification of the market. According to Statista France, Burger King’s market share has grown considerably, capturing the attention of younger demographics.

- Consumer Habits: A substantial portion of the population—nearly 50%—reported having eaten at McDonald’s at least once in the last six months of 2023. This statistic highlights the strong demand for fast food options in France and the entrenched presence of major fast food brands. L’Observatoire Cetelem has noted a trend towards more frequent visits to fast food outlets, particularly among urban populations.

Sources: INSEE, The Connexion, MarketResearch, INSEE,

Evolving Consumer Behavior

Consumer behavior in France is increasingly shaped by convenience, lifestyle factors, and the ongoing effects of the COVID-19 pandemic. These factors have significantly influenced the growth and evolution of the fast food industry.

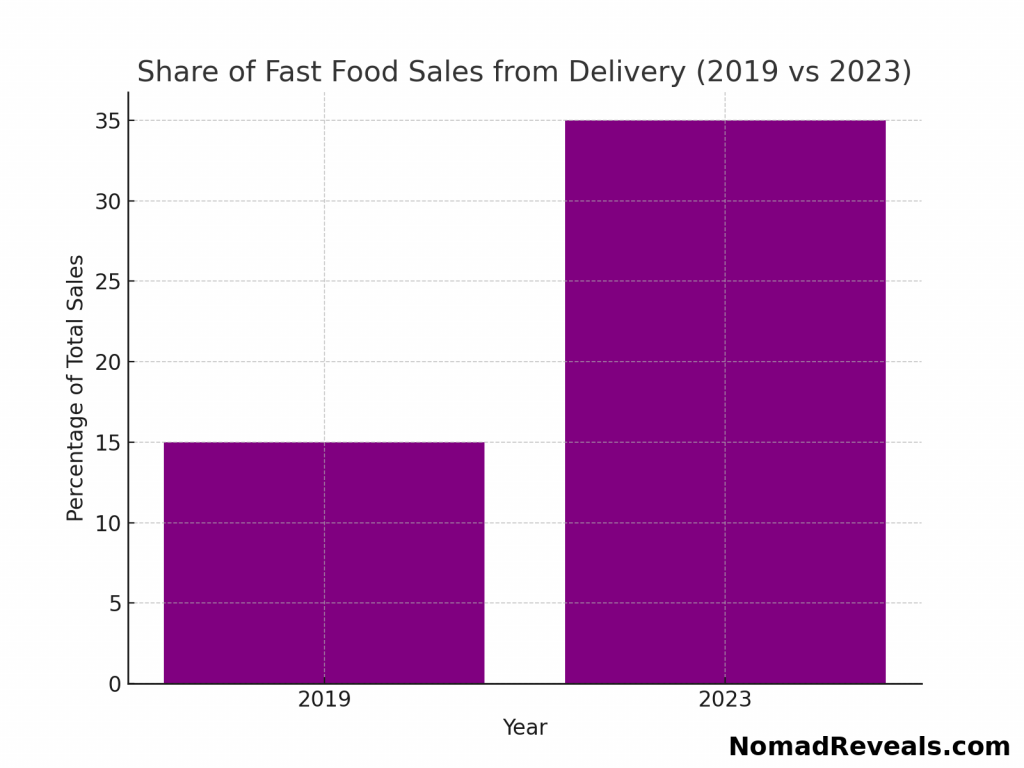

- Food Delivery Growth: The popularity of food delivery services has surged, with companies like UberEats and Deliveroo expanding their operations. This trend, driven by changing consumer habits and the convenience of online ordering, continues to contribute significantly to the growth of the fast food sector. INSEE reports that food delivery has become a crucial component of the fast food industry, with a growing percentage of revenue coming from online orders.

- Glocalization of Menus: Fast food chains are increasingly tailoring their offerings to local tastes, a strategy known as “glocalization.” This is evident in the popularity of localized menu items such as McDonald’s McBaguette, which combines global fast food concepts with French culinary traditions. Gira Conseil highlights that the success of these localized offerings is a key factor in the sustained growth of international fast food chains in France.

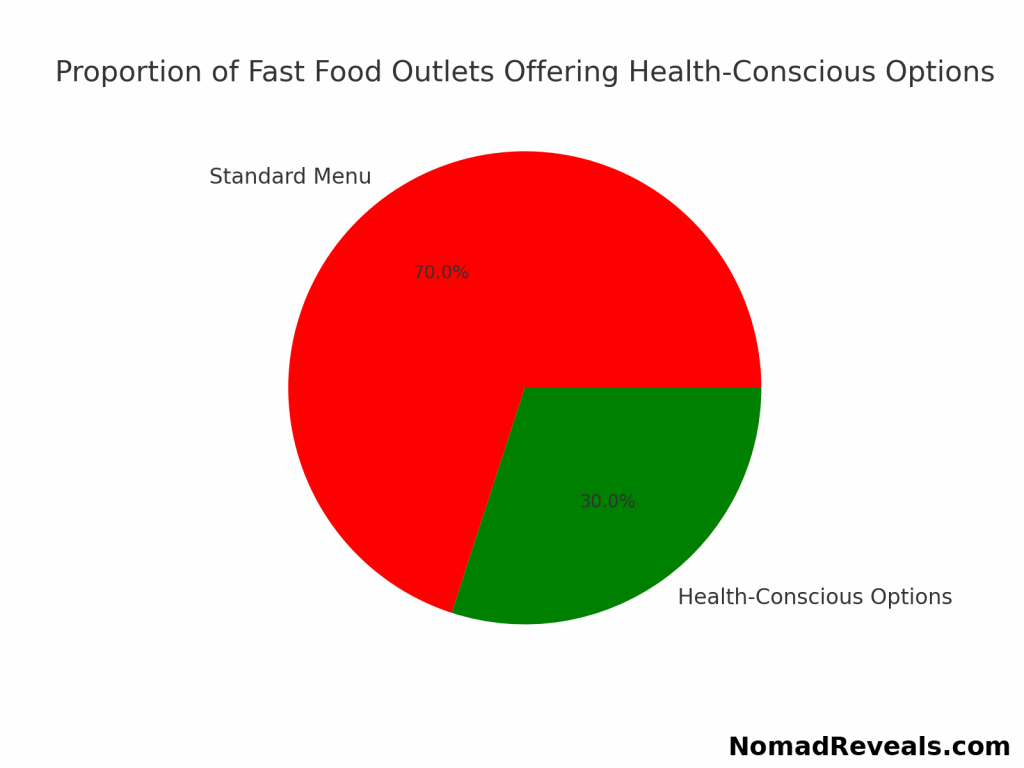

- Health-Conscious Choices: There is a growing demand for healthier fast food options, with chains expanding their menus to include vegetarian, vegan, and lower-calorie choices. This shift reflects broader consumer trends towards health and wellness, even within the fast food sector. Les Échos has reported an increase in consumer preference for healthier menu options, particularly among younger and more health-conscious demographics.

Sources: MarketResearch, The Connexion, INSEE

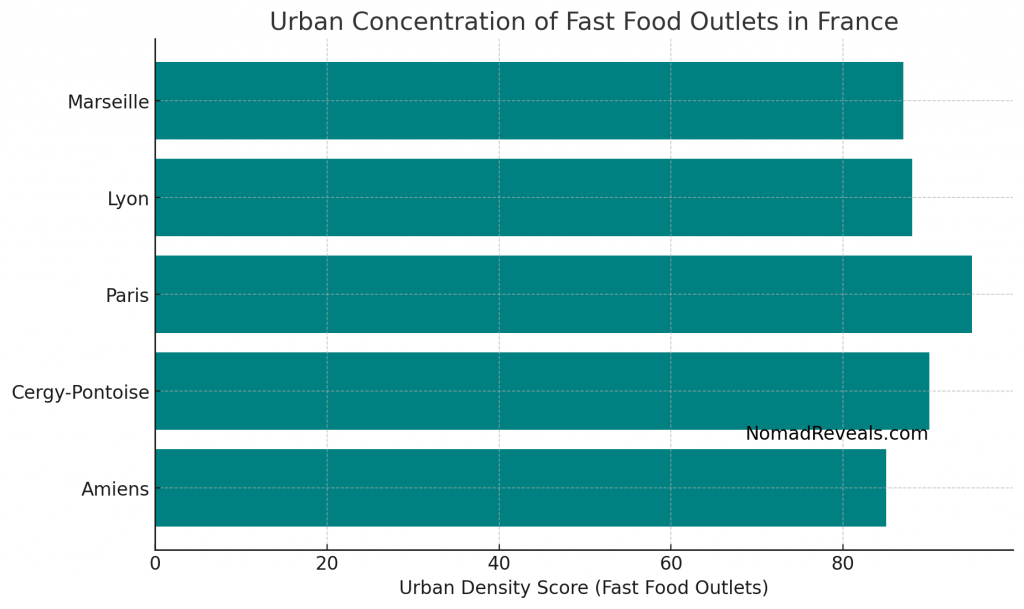

Regional Insights and Urban Concentration

The distribution of fast food outlets across France reveals interesting regional trends, particularly in urban areas where these establishments play a significant role in local economies and communities.

- Urban Density: In cities like Amiens and Cergy-Pontoise, fast food outlets account for about 15% of all businesses, highlighting their prevalence in urban settings. This concentration underscores the role of fast food in meeting the demands of busy urban lifestyles. INSEE data shows that urban areas continue to dominate the fast food landscape, with higher densities of outlets in cities compared to rural areas.

- Youth and Community Impact: Fast food establishments often serve as social hubs for younger demographics, especially in areas where traditional dining options are less common. This trend is particularly noticeable in suburban and peri-urban areas, where fast food chains provide both social spaces and convenient dining options. L’Observatoire Cetelem notes that these establishments are increasingly popular among teenagers and young adults, who view them as affordable and accessible meeting spots.

- Rural Expansion: While urban areas dominate the fast food landscape, there is a growing trend of fast food outlets expanding into rural regions. This expansion is driven by increasing mobility and the demand for convenient dining options in less densely populated areas. Statista France indicates that rural regions are seeing a gradual increase in the presence of fast food chains, particularly along major transportation routes.

Sources: MarketResearch, The Connexion, INSEE

Competitive Landscape and Market Segmentation

The competitive landscape of the French fast food industry is characterized by both international giants and local players, each targeting different market segments.

- International Chains: Major international chains like McDonald’s, Burger King, and KFC dominate the market, leveraging their brand recognition and extensive supply chains. These companies continue to expand, introducing new outlets and menu items to capture a larger share of the market. Gira Conseil reports that these chains collectively hold a significant portion of the market share, with McDonald’s leading the pack.

- Local and Regional Chains: French fast food chains, such as Quick and O’Tacos, offer localized alternatives to the global giants. These chains often emphasize unique menu offerings that cater specifically to French tastes, such as French tacos and other fusion dishes. Les Échos highlights the competitive edge that these chains have in attracting customers who prefer locally-inspired fast food options.

- Premium Fast Food: There is a growing segment of premium fast food, with brands like Big Fernand and Le Camion Qui Fume catering to consumers seeking higher-quality ingredients and gourmet options. This segment appeals particularly to urban professionals and younger consumers looking for a balance between convenience and quality. L’Observatoire Cetelem has observed that this premium segment is expanding, driven by a demand for more refined fast food experiences.

Sources: MarketResearch, The Connexion, INSEE

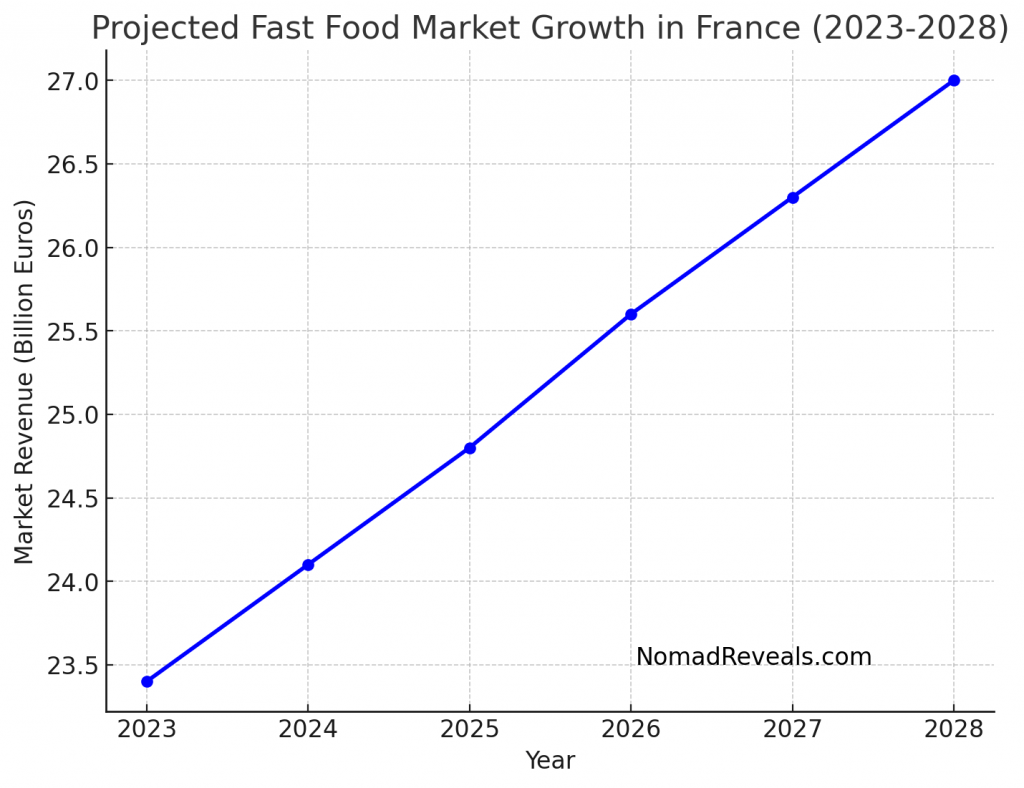

Future Projections and Market Trends

Looking ahead, the fast food industry in France is poised for continued growth, driven by several key factors. The industry is expected to adapt and evolve in response to changing consumer preferences, technological advancements, and competitive pressures.

- New Entrants: The introduction of new international brands, such as Wendy’s, is expected to further invigorate the market and diversify consumer choices. These new entrants will likely compete on both price and innovation, offering fresh challenges to established players. Statista France predicts that these new brands will bring more competition to the fast food market, potentially leading to increased innovation and menu diversification.

- Sustained Consumer Spending: With economic conditions improving, consumers are likely to maintain or increase their spending on fast food. The convenience and affordability of fast food continue to make it an attractive option, especially as disposable incomes rise. INSEE data suggests that consumer spending on fast food is set to grow steadily, supported by positive economic indicators.

- Innovation and Adaptation: The industry is expected to continue evolving, with fast food chains likely to introduce more localized menu options and enhance delivery services to meet changing consumer needs. Technological innovations, such as mobile ordering and automated kitchens, are also expected to play a significant role in the future of fast food. Gira Conseil anticipates that innovation will be a key driver of growth, particularly in urban markets where competition is fierce.

Sources: MarketResearch, The Connexion, INSEE

References:

- Statista France – French Market Data

- Connexion France – Why Fast Food Restaurants are Booming in France

- MarketResearch.com – France Fast Food Market Research Reports & Analysis

- INSEE – Institut National de la Statistique et des Études Économiques

- Gira Conseil – Foodservice Market Reports

- L’Observatoire Cetelem – Consumer Trends in France

- Les Échos – French Business and Financial News

You Might also Like